Bagley Risk Management Solutions: Your Guard Versus Uncertainty

Bagley Risk Management Solutions: Your Guard Versus Uncertainty

Blog Article

Comprehending Animals Threat Protection (LRP) Insurance Coverage: A Comprehensive Guide

Browsing the realm of animals danger security (LRP) insurance policy can be a complicated endeavor for several in the agricultural field. From exactly how LRP insurance works to the numerous coverage alternatives offered, there is much to discover in this extensive guide that could possibly form the method animals manufacturers approach threat management in their companies.

Just How LRP Insurance Functions

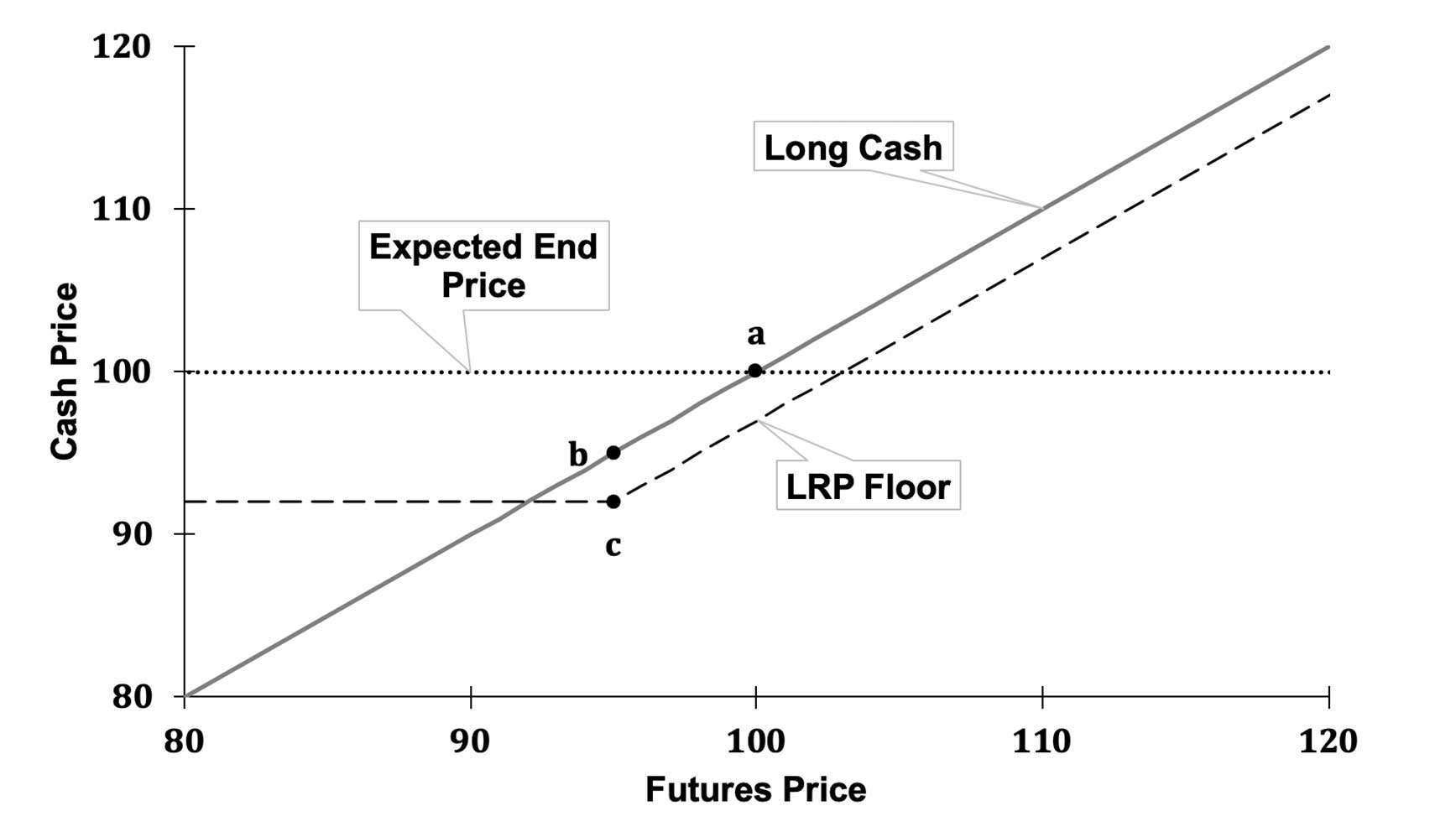

Sometimes, understanding the mechanics of Animals Danger Protection (LRP) insurance coverage can be intricate, but damaging down just how it works can offer clearness for ranchers and farmers. LRP insurance policy is a threat administration tool made to shield animals manufacturers against unexpected cost decreases. It's essential to note that LRP insurance is not an earnings warranty; instead, it concentrates entirely on rate threat defense.

Eligibility and Coverage Options

When it involves insurance coverage alternatives, LRP insurance offers manufacturers the flexibility to choose the protection level, coverage duration, and recommendations that finest suit their threat monitoring requirements. Protection levels usually range from 70% to 100% of the expected finishing value of the insured livestock. Producers can likewise pick protection periods that line up with their production cycle, whether they are insuring feeder livestock, fed cattle, swine, or lamb. Endorsements such as price risk security can even more tailor insurance coverage to shield versus damaging market variations. By comprehending the qualification criteria and coverage alternatives available, livestock manufacturers can make educated decisions to take care of risk efficiently.

Pros and Disadvantages of LRP Insurance Policy

When examining Animals Risk Protection (LRP) insurance, it is important for animals producers to evaluate the drawbacks and benefits integral in this threat administration device.

One of the primary benefits of LRP insurance is its ability to offer security versus a decline in livestock rates. This can aid secure manufacturers from financial losses arising from market variations. In addition, LRP insurance coverage uses a level of versatility, enabling manufacturers to personalize insurance coverage levels and plan periods to fit their particular demands. By securing in an assured cost for their animals, producers can better take care of risk and prepare for the future.

One constraint of LRP insurance policy is that it does not protect versus all kinds of risks, such as illness break outs or natural disasters. It is essential for read review producers to thoroughly evaluate their private risk direct exposure and economic situation to establish if LRP insurance coverage is the right risk administration device for their operation.

Recognizing LRP Insurance Policy Premiums

Tips for Making Best Use Of LRP Conveniences

Maximizing the benefits of Animals Risk Defense (LRP) insurance needs critical planning and proactive danger monitoring - Bagley Risk Management. To make the most of your LRP insurance coverage, take into consideration the adhering to suggestions:

On A Regular Basis Examine Market Problems: Stay educated concerning market trends and cost variations in the livestock sector. By keeping track of these factors, you can make educated decisions regarding when to buy LRP coverage to safeguard versus possible losses.

Set Realistic Insurance Coverage Degrees: When choosing protection degrees, consider your manufacturing prices, market price of animals, and potential threats - Bagley Risk Management. Setting practical coverage levels makes sure that you are effectively safeguarded without overpaying for unneeded insurance coverage

Diversify Your Protection: As opposed to relying only on LRP insurance policy, think about expanding your danger management strategies. Integrating LRP with various other threat management tools such as futures agreements go to website or alternatives can provide comprehensive coverage against market unpredictabilities.

Evaluation and Change Coverage Regularly: As market problems alter, occasionally assess your LRP coverage to ensure it aligns with your existing risk exposure. Adjusting coverage degrees and timing of acquisitions can aid maximize your threat security method. By following these suggestions, you can optimize the benefits of LRP insurance and guard your animals operation against unforeseen dangers.

Conclusion

In verdict, animals threat security (LRP) insurance is a beneficial device for farmers to take care of the monetary threats related to their animals procedures. By understanding exactly how LRP functions, eligibility and coverage choices, as well as the pros and cons of this insurance policy, farmers can make informed decisions to secure their resources. By carefully thinking about LRP premiums and carrying out methods to make best use of benefits, farmers can minimize prospective losses and make certain the sustainability of their operations.

Livestock producers interested in acquiring Livestock Risk Protection (LRP) insurance policy can check out an array of qualification standards and insurance coverage choices tailored to their specific animals operations.When it comes to insurance coverage choices, LRP insurance policy supplies manufacturers the versatility to select the protection degree, protection duration, and endorsements that finest match their threat management demands.To understand the intricacies of Animals Risk Security (LRP) insurance coverage totally, comprehending the variables influencing LRP insurance costs is essential. LRP insurance premiums are determined by various components, consisting of the insurance coverage level chosen, the expected cost of livestock at the end of the insurance coverage duration, the type of livestock being guaranteed, and the size of the insurance coverage period.Evaluation and Change Coverage On a regular basis: As market problems transform, periodically review your LRP insurance coverage to guarantee it straightens with your existing danger direct exposure.

Report this page